Specialist advice for financing charities and social enterprises

Wrigleys has a long track record of advising impact investors on investments that deliver positive environmental or societal change.

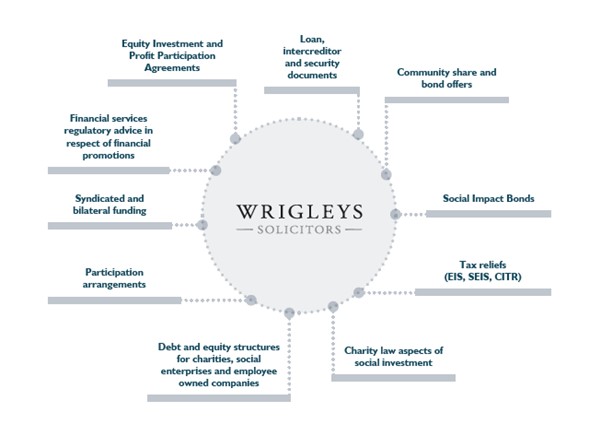

We advise financial institutions, charities, social enterprises, and employee-owned companies of all shapes and sizes, and across a variety of sectors, seeking to provide or raise finance. From drafting and reviewing loan, intercreditor and security documentation to advising on community share and bond offers, our breadth of expertise means we can provide significant support in this field.

We act for several social impact investors, the social investment arms of a number of charitable foundations, several impact investment wholesalers and distributors of dormant assets money, community development finance institutions, enterprise funds and credit unions, so we understand the opportunities and challenges facing our clients and other organisations operating in the sector.

We have contributed to the development of this field through our involvement with studies and publications for the European Commission and the Charities Aid Foundation, and the establishment of the CDFA and the UK Sustainable Investment and Finance Association.

Wrigleys is a corporate member of the Global Alliance of Impact Lawyers (GAIL), a community of legal leaders who use the practice of law to positively impact people and the planet.

We are also listed as a recognised advisor by Good Finance UK, a collaborative project to help improve access to information on social investment for charities and social enterprises. Their mission is to be the single trusted source of information on social investment for charities and social enterprises.

'Allia has been relying on the advice and expertise of Wrigleys for over 20 years. The team combines deep knowledge of their field with sensible practicality and commercial awareness, and I am glad to have them as both valued advisors and friends.'

Phil Caroe, Director Deal Execution, Allia

'The Wrigleys team provide excellent support. They are skilled finance lawyers who also understand the social impact we’re trying to create. They know the social investment sector and help us to build strong relationships with the organisations we invest in.'

Charlotte Benson, Co-Head of Legal, Better Society Capital